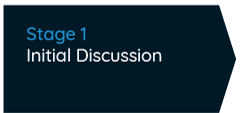

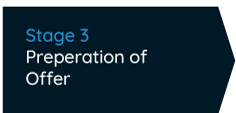

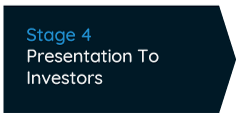

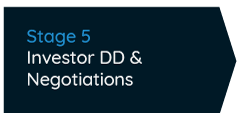

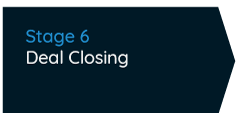

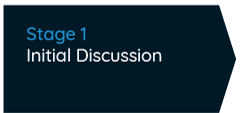

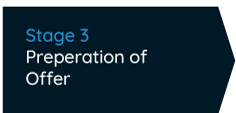

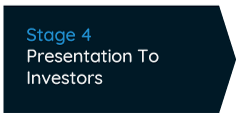

Our Process

Below is an illustration of the process we go through with our M&A client.

Panyu Holdings specializes in business acquisitions. We help SME business owners grow or exit their businesses. We are experts in unlocking the value tied up in a business and its shareholdings.

Our ideal client for M&A has an annual gross profit of $1m to $20m USD and ideally in an established brick and mortar business. We can work with companies anywhere in the world, and are especially strong in SE Asia.

Panyu’s solutions include direct access to investment from Asian corporates, European public listings, and local boutique investment.

The process of taking on investment or selling a business involves considerable trust, patience and understanding. Our promise to our clients is to always work with them with a high level of integrity, professionalism and clear communication. Those qualities have been key to developing our long lasting relationships.

By working on a success fee, our interests and our client’s interests are aligned.

We represent our client to the investor/buyer; we are not a middleman.

Our success fee structure and working model is 100% transparent to our clients.

We understand the sensitivity of our discussions and their impact on your business and partnerships.

We have a broad network of partners in Asia, Europe and North America.

We understand our target investors’ mindset, processes and requirements.

We help SME business owners unlock shareholder value and liquidity through our services.

We work directly with some of the largest consulting firms and banks in Japan to help their institutional clients expand their businesses into Southeast Asia via strategic acquisitions. We also work in a similar capacity with several SE Asian family offices and regional investment partners.

We communicate directly with the decision makers and have a clear understanding of how they work, value a company and what it takes to close a deal with them. We bring this experience, understanding and opportunity to our clients.

Our role is to represent the company being acquired, while our counterpart in the other organization represents, or is, the investor/buyer.

We will do a preliminary valuation of our client’s business before discussing their investment options, followed by mandating us to represent them to our prospective investors. During the investor’s due diligence process, we represent our clients, allowing them to focus on running their business. Once formal negotiations begin, we continue to advise and guide our clients.

A diversified investment holding group (DIHG) is an aggregation of several independent companies under the umbrella of a parent holding group. We bring profitable and debt free SME businesses to our listed DIHG partners in Europe when they fit into suitable industry verticals.

This arrangement offers a variety of benefits to our SME clients, solving the problems of scale, opening new access to capital, qualifying for bigger projects and enjoying economies of scale.

As part of a bigger DIHG, the SME business will find it easier to seek and retain talent and to access overseas markets through synergies within the DIHG.

Collectively in a diversified structure across multiple geographies, the DIHG is much more resillent to cyclical business cycles and political stability.

For profitable SME businesses which are not yet ready or suitable for either M&A or DIHG, we can have the option to invest directly into the business, either alone or with strategic partners.

For SME business in a distressed position, we will study the business in detail, identify where our team could add value and potentially turnaround the operations, thus preserving the legacy of the business.

We will first do a preliminary valuation of the business and discuss the investment options available. There are different ways we can make an investment into the SME business. Generally we prefer to take a majority stake.

We will work closely with the business owner during a transition period, with an option for the business owner to stay on in an advisory or management role afterwards. Should the business owner wish to exit the business entirely, we will establish an appropriate succession plan.

Below is an illustration of the process we go through with our M&A client.

Reach out to us today for a friendly chat and explore the various options available for your business!

6 Ubi Road 1 #08-04 Wintech Centre Singapore 408726

contact[@]panyuholdings.com